House Affordability Calculator Alberta

GST rebates are calculated as follows. 525 effective June.

Smart Enclosure Masonry Enclosure Passive House Masonry

Your current mortgage would be paid in full in approximately 264 yearsIt would cost 3001626 in interest over the 26 months remaining in your term.

House affordability calculator alberta. Our Mortgage Affordability Calculator applies the federal lending. For an accurate assessment please complete a pre-approval. The debt-to-income ratio DTI is your minimum monthly debt divided by your gross monthly income.

For homes under 350000 the rebate amounts to 36 of GST up to a maximum rebate of 6300. A mortgage specialist will look at your situation to discuss your options. You can afford a home up to.

This calculator is for illustrative purposes only. The monthly cost of property taxes HOA dues and homeowners insurance. For the purposes of this tool the default insurance premium figure is based on a premium rate of 40 of the mortgage amount which is the rate applicable to a loan-to-value ratio of 9001 9500.

The calculator can estimate your living expenses if you dont know them. Compare rates payment frequency amortization and more to find your best mortgage options. For homes that cost between 500000 and 1000000 the minimum down payment is 5 of the first 500000 plus 10 of the remaining balance.

To use our mortgage affordability calculator simply enter you and your partners income or your co-applicants income as well as your living costs and debt payments. The mandatory insurance to protect your lenders investment of 80 or more of the homes value. To get the most accurate result make sure to indicate all of the figures for your monthly expenditures.

The income required to afford the average home price was calculated using the Ratehub mortgage affordability calculator wwwratehubcamortgage-affordability-calculator assuming a 20 down payment a mortgage rate of 333 and a 30-year amortization. Affordability calculators need to take into account government stress testing regulations published by the Office of the Superintendent of Financial Institutions OSFI. In order to be approved for a mortgage you will need at least 5 of the purchase price as a down payment if your purchase price is within 500000.

The calculator helps determine how much you can afford based on your yearly incomealong with the income of anyone else purchasing a home with you and your monthly expenses. Your down payment can limit the above amount in various ways. This calculator calculates GST at 5 of a new homes purchase price minus a GST rebate.

Choose a term and interest rate that best suits your needs and your timeline. This is the purchase price minus your down payment. The calculation does not factor in carrying costs such as property taxes and heating.

Debt-to-income affects how much you can borrow. Multiply the years of your loan by 12 months. How Much House Can You Afford.

CMHC is not be liable for loss or damage of any kind arising from the use of this tool. The traditional monthly mortgage payment calculation includes. For homes that cost over 1000000 the minimum down payment is 20.

Find an estimate of how much mortgage or rent you can afford. Following federal lending guidelines up to 60000. Quickly find the maximum home price within your price range.

The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments. You have approximately 15000000 of equity in your home. The amount of money you borrowed.

You must still be able to afford your mortgage payments if your interest rate increases to the greater of. The Bank of Canada five-year benchmark rate of. For down payments of less than 20 home buyers are required to purchase mortgage default insurance.

Compare your monthly debt payments and housing expenses to your gross. With these numbers youll be able to calculate how much you can afford to borrow. For homes between 350000 and 450000 the maximum rebate of 6300 declines to zero on a proportional basis.

If your purchase price is between 500000 and 1000000 your minimum down payment is 5 of the first 500000 and 10 of the price between 500000 and 1000000. This mortgage calculator can be used to figure out monthly payments of a home mortgage loan based on the homes sale price the term of the loan desired buyers down payment percentage and the loans interest rate. The above calculation is a rough estimate based on your income and the Government of Canadas 5-year stress test rate necessary for qualifying.

Use the mortgage calculator affordability calculator and debt service GDS and TDS calculator. To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related. Contact us for more information about financing your next real estate purchase.

At the same rate the interest you would pay from now to the end of the amortization would be 21582713. While every effort is made to keep this tool up-to-date CMHC does not guarantee the accuracy reliability or completeness of any information or calculations provided by this calculator. Term and Interest rate.

The cost of the loan.

Mortgage Affordability Calculator Based On New Cmhc 2021 Rules Wowa Ca

How Much Mortgage Can I Afford Ratehub Ca

As Overvaluation Risk Rises Housing Affordability Is Deteriorating Again Ratesdotca

Mortgage Affordability Calculator Based On New Cmhc 2021 Rules Wowa Ca

How To Use Mortgage Calculators Moving2canada

Here S How Much House You Can Afford Under Canada S New Mortgage Rules Huffpost Canada Business

When Your Ready To Buy Your First Home Let Redefined Realty Advisors Help You Give Us A Call Today 26 Buying Your First Home Home Buying Home Interest Rates

Buying A Home How Much Mortgage Can I Afford

Interesting Facts About Income Tax Income Tax Fun Facts Tax

11 Disadvantages Of Car Insurance Group Cost Calculator And How You Can Workaround It Car Insuranc Car Insurance Car Insurance Comparison Geico Car Insurance

Trusted Red Deer Mortgage Broker Whalen Mortgages Mortgage Brokers Mortgage Mortgage Loans

Canadian Mortgage Affordability Calculator Canada Home Loan Income Qualification Tool

700k Mortgage Mortgage On 700k Bundle

Auto Loan Miami Car Loans Easy Cash Good Credit

Home Affordability Calculator For Excel

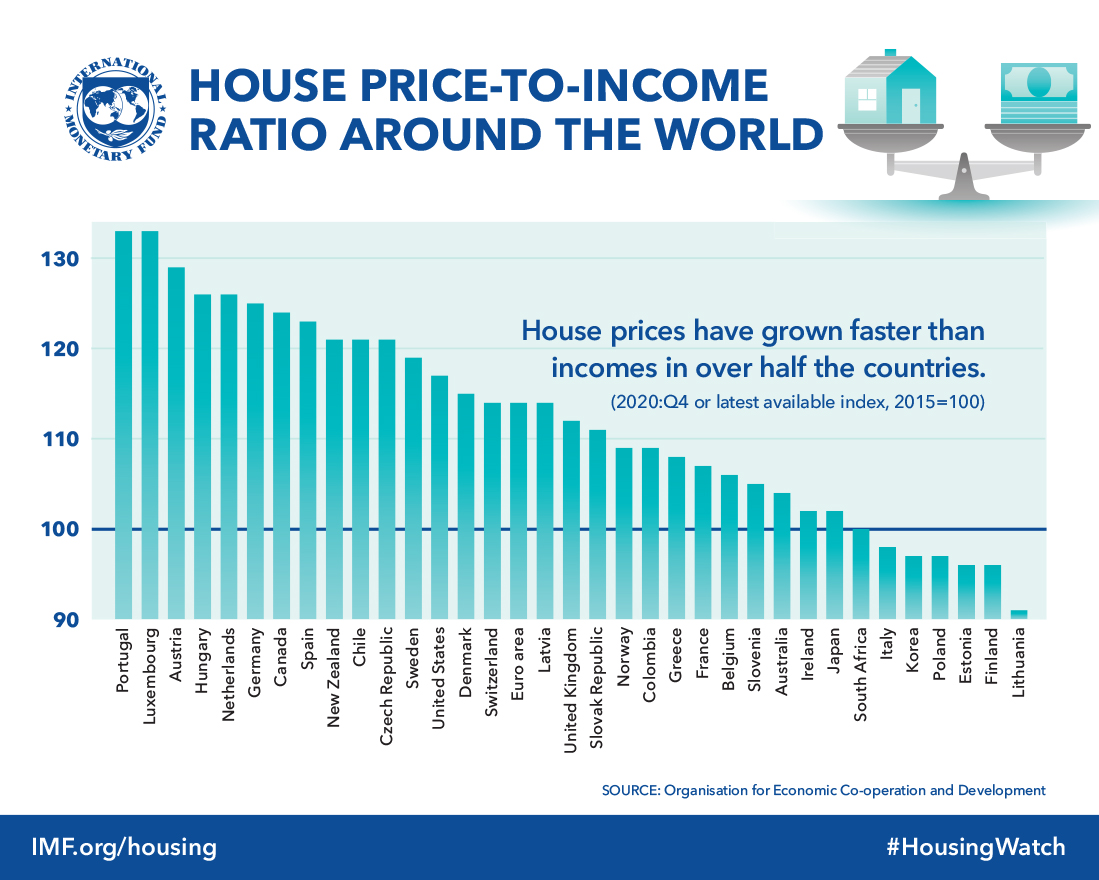

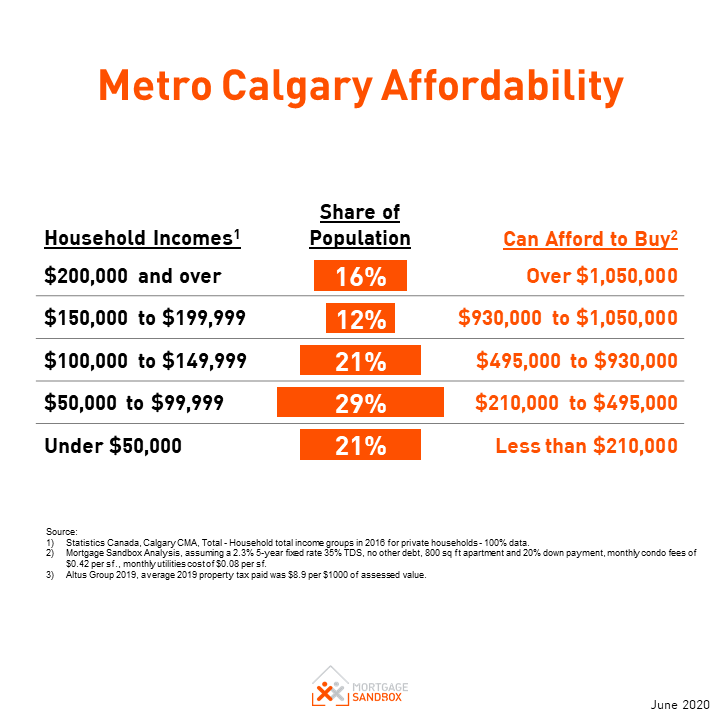

Metro Calgary Home Price Forecast July 2020 Mortgage Sandbox

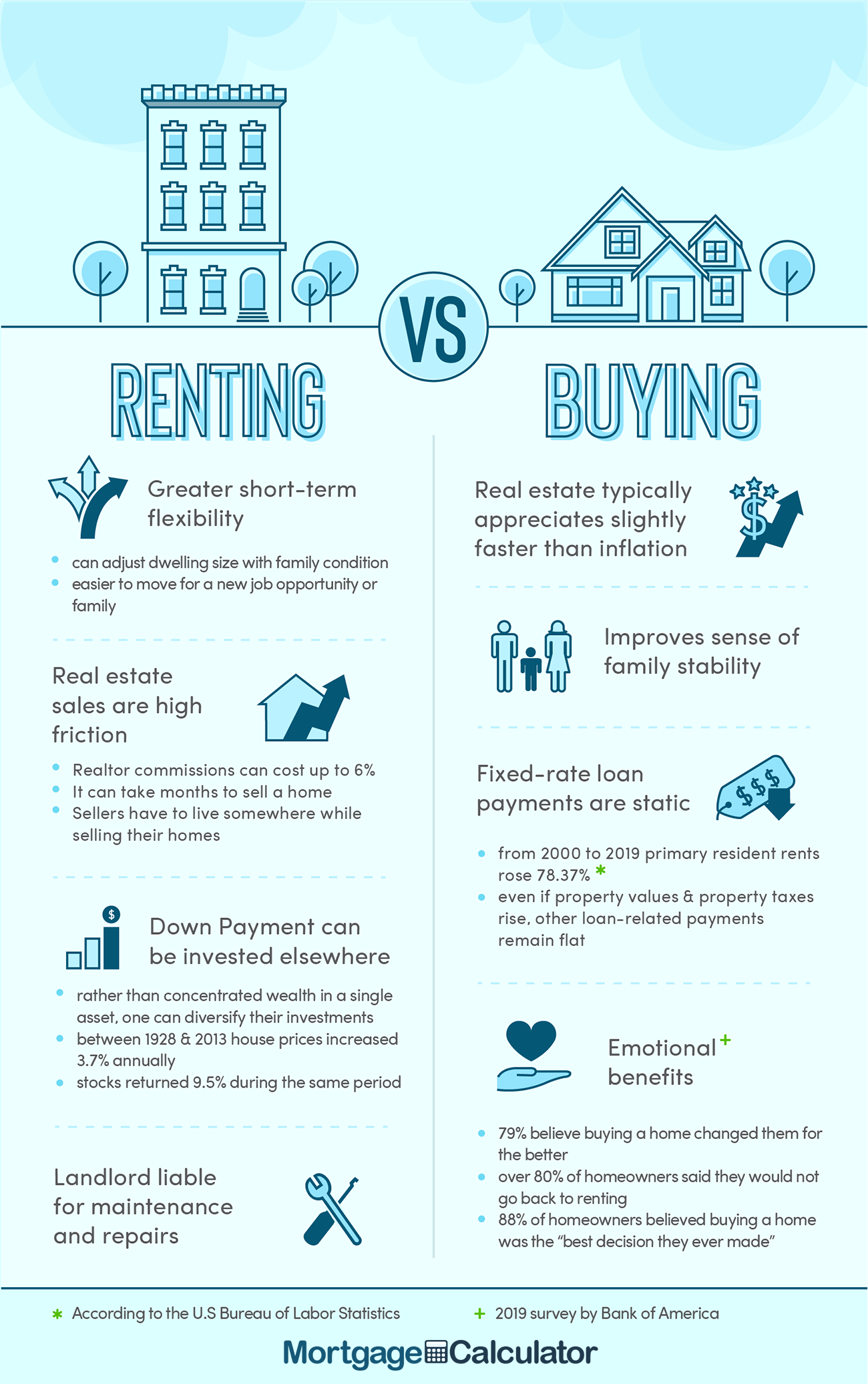

How To Decide If A Property Is A Good Investment The Washington Post

Post a Comment for "House Affordability Calculator Alberta"